Posts

Additionally you do not are withdrawals out of your Roth IRA which you roll-over tax free to the other Roth IRA. You may need to is section of most other withdrawals on the money. The other income tax on the very early withdrawals are ten% of the number of the first shipping you need to is on your own revenues. So it income tax is in introduction to any typical tax ensuing away from like the shipment inside the money. Only the area of the shipment you to means nondeductible contributions and rolled more than just after-tax quantity (their rates foundation) is actually tax free. Up to all your foundation has been distributed, for each delivery is actually partly nontaxable and you can partly nonexempt.

- These are taxes enforced by the a foreign nation otherwise any one of their governmental subdivisions.

- On the internet step three of the worksheet, they enter $40,five hundred ($38,100 + $dos,500).

- You must explore an indicator language interpreter while in the group meetings when you is at performs.

- Essentially, you might deduct assets taxes only if you’re a holder of the home.

- Your didn’t allege the brand new area 179 deduction or the unique depreciation allowance.

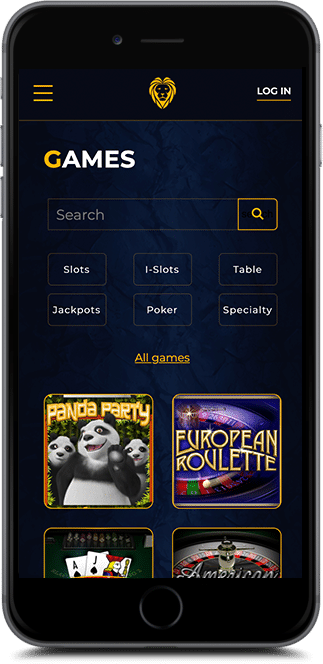

What kind of no-deposit local casino bonuses can i claim? – ice hockey $1 deposit

Since the name indicates, this type of free revolves do not have any betting criteria. Casinos on the internet are happy to do business with all of us while the i send her or him valuable visitors. Reciprocally, they go the additional kilometer by providing you that have exceptionally big incentives which they couldn’t want to market on their own sites. Developing solid a lot of time-identity matchmaking having finest casinos brings you to the financing to negotiate private bonuses that you claimed’t come across to your all other webpages outside of NoDepositKings. I wear’t hop out your choice of more winning gambling establishment bonuses to help you possibility.

Come across Choice Minimum Income tax (AMT) within the chapter 13 for more information. 550, chapter step 1 consists of a discussion on the private pastime ties under County or State Personal debt. Income on the property is taxable on the man, besides people region used to satisfy a legal obligation to help you secure the ice hockey $1 deposit man is nonexempt on the father or mother or protector having you to definitely court obligation. This type of laws connect with each other mutual control by the a married few and also to combined control by the others. For example, for individuals who unlock a mutual bank account together with your boy using financing of the man, listing the fresh child’s term very first to the account and present the new kid’s TIN.

Benefits gotten away from an employer-funded fund (to which the staff didn’t lead) aren’t jobless compensation. For more information, come across Extra Unemployment Payment Advantages inside part 5 from Pub. Declaration such costs on the web 1a out of Mode 1040 otherwise 1040-SR. For those who sell your complete need for oil, gasoline, or mineral legal rights, the total amount you can get is considered percentage to your sales of assets used in a swap otherwise team less than section 1231, maybe not royalty income. Under particular points, the new product sales try susceptible to funding gain or losses medication because the explained from the Instructions to have Plan D (Mode 1040). For more information on offering point 1231 assets, discover section 3 from Pub.

Financial movie director

Some of these casinos require you to withdraw more the brand new minimal deposit number, even though – look out for it whenever playing during the reduced minimum put gambling enterprises inside the October 2025. A knowledgeable United states of america no-deposit web based casinos inside the 2023 mix advertising also provides one to wear’t want in initial deposit that have series out of game loves harbors and you can blackjack. When an internet site . has a good support service department and a good reputation for to the-date percentage, such the higher. Throwing away money sucks, especially when they’s going down a sink out of a All of us internet casino your don’t become taste. And let’s think about it, some online gambling web sites provides over the top minimum deposit amounts, and therefore’s particularly unpleasant for those who are just getting into on the internet betting. If you’re also sick of ridiculous put standards, the rage ends here and you will today.

Exclusion to the fifty% Restriction for Meals

Overview of your tax get back the total focus earnings you receive to your taxation 12 months. Understand the Setting 1099-INT Tips to have Recipient to see if you should to improve all number stated for your requirements. For those who go back to performs once qualifying to possess workers’ payment, paycheck repayments you can get for performing light commitments is actually taxable while the earnings. 915, Public Defense and you will Comparable Railroad Pensions.

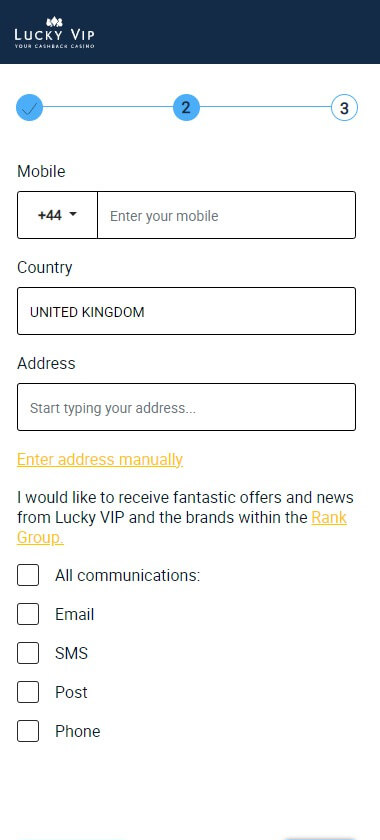

How to allege the fresh $step one put extra in the Gambling Pub

Someone inside Singapore have the opportunity to earn large welfare which have discover bank discounts and you may fixed otherwise go out put account. This guide provides an out in-depth look at the best rates readily available. Access borrowing from the bank and you can establishing a credit history allow it to be households to easy consumption, make money, and you will weather monetary unexpected situations. Although not, many houses avoid using mainstream credit, and you can perform to boost use of as well as affordable borrowing remain very important. So when a lot more consumers access conventional borrowing from the bank, focused outreach and you may knowledge in the controlling and you may building borrowing could be rewarding to help with winning usage of borrowing. As well, lenders and you can people the exact same create make use of more detailed and you can clear factual statements about the brand new effect away from time and you may type of credit play with to the credit history and you can ratings.

Additionally you get access to perks such as on the web expenses spend and you may mobile view put. HSBC even brings endless rebates on the third-team Atm costs in america. The fresh bank account in addition to will pay 0.01% APY for the balance of $5 or higher. An educated financial incentives of 2025 are really easy to earn and you may help you to get anything in exchange when starting a new account. Discover a knowledgeable bank bonuses from 2023 and grab your opportunity to make advantages while you are starting a new membership. Of hefty dollars bonuses to help you constant perks, find the best lender campaigns customized to different buyers demands, to make your financial sense much more satisfying.

Lost otherwise Mislaid Bucks otherwise Assets

Although not, some other laws could possibly get apply if you live inside the a residential area possessions county. Install Mode 1099-R on the papers get back if container cuatro shows government earnings taxation withheld. Include the amount withheld on the total on the internet 25b away from Form 1040 or 1040-SR. Concurrently, Mode W-2 is utilized to report any nonexempt ill spend your obtained and you may people income tax withheld out of your unwell pay.

Getting display screen topic one advertises your online business on the auto doesn’t change the entry to the car out of private use to company fool around with. If you are using which auto for travelling and other individual uses, you still is also’t deduct your own expenses for these uses. You could potentially’t subtract the expenses of delivering a shuttle, trolley, train, otherwise cab, or of worries involving the home plus main otherwise typical workplace.

Making use of your Desktop computer

You may find Worksheet 3-step one useful in calculating whether your given over fifty percent away from another person’s service. Somebody who died in the 12 months, however, resided to you while the a part of one’s house up to death, can meet it try. A comparable is true for a young child who had been produced while in the the entire year and you will lived with you since the a member of your home throughout the season.